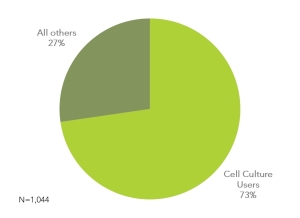

Cell Culture is among one of the most widely used research methods in life science laboratories globally, and is present in 73% of the laboratories recently polled by Percepta (see figure).

This large market has the attention of many suppliers wanting their fair share of the research dollars being spent. However, recent mergers and acquisitions have resulted in some significant changes in the positions of some cell culture suppliers in recent years. In the past several smaller moves including Lonza buying Cambrex and Mediatech joining Corning were typical in the market but in 2014 there were a few blockbuster shifts in the supplier market as Thermo Fisher Scientific traded its Hyclone franchise to GE Healthcare and picked up the market leading Gibco as part of the Life Technologies acquisition and Sigma-Aldrich was acquired by Merck. So has all of this moving and shaking resulted in any serious disruption of market leaders?

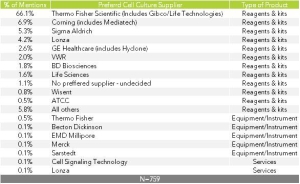

We asked over 1,000 scientists around the world which cell culture supplier they prefer (i.e. used most often). The table below shows that the supplier most preferred, Gibco (now part of Thermo Fisher Scientific) remains the strong leader for cell culture reagents & kits among life science researchers and is preferred by more than 66% of the 759 cell culture scientists responding to the poll. The change in parent company did not lead to a leadership change roughly one year after the deal was closed. Corning and Sigma-Aldrich (now part of Merck) are fairly distant second position suppliers, delivering 6.9% and 5.3% of mentions, respectively. In the mean time Hyclone (now owned by GE Healthcare) is preferred by roughly 2.6% and holds the 4th position for cell culture reagents & kits used in research. Though this is no measure of revenue share or actual size of the organizations mentioned it does give some sense of the suppliers first to mind for cell culture materials used in research laboratories.

Leave a Reply