We set out to understand, at a top level, which life science suppliers are recognized in the industry for having the most flexible pricing options, for reagents and for instruments. The questions posed to North American, European and Chinese audiences were:

Q. Which life science reagent supplier has the most flexible pricing options? [free text]

Q. Which life science instrument supplier has the most flexible pricing options? [free text]

The responses were unprompted and participants simply wrote in an online survey their supplier of choice. The questions were stated in English language for North America and Europe and in Chinese for China.

These questions were posed online to Percepta’s global panel of active life science researchers in quarter 2 of 2013. The number of responses collected and analyzed are summarized in the table below.

Key Findings

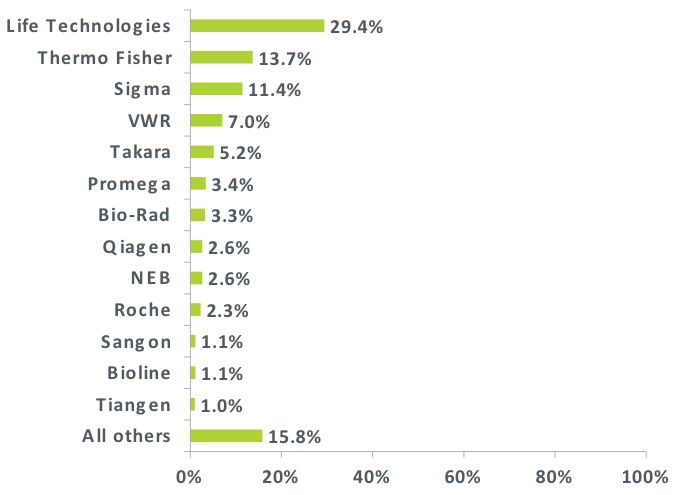

Reagents

Overall thirteen suppliers account for 85% of the global citations for most flexible reagent pricing options:

Life Technologies leads the industry in recognition for price flexibility in the reagents category with over a quarter of global citations. Thermo Fisher Scientific and Sigma are the only other suppliers to garner more than 10% of global citations.

On a regional basis the leaders generally mirror the global findings with a few exceptions. Download full report to view findings by region and full listing of supplier rankings.

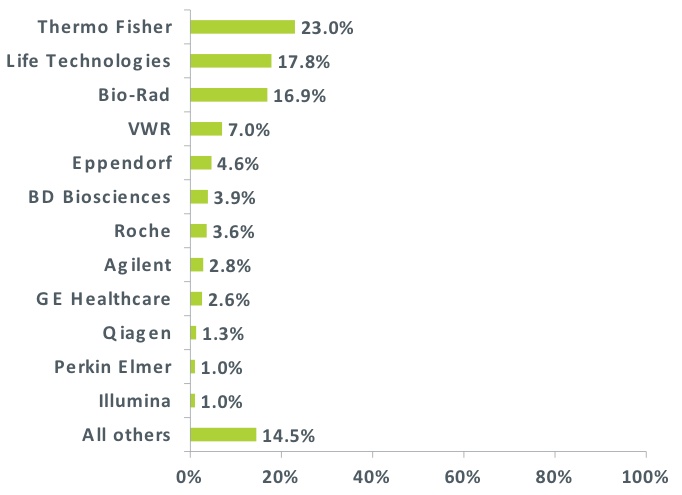

Instruments

Overall twelve suppliers account for 85% of the global citations for most flexible instrument pricing options:

Thermo Fisher Scientific enjoys leadership in recognition for price flexibility in the instruments category with over a fifth of global citations. Life Technologies and Bio-Rad are the only other suppliers to garner more than 10% of global citations.

On a regional basis, once again, the leaders are generally the same but with some position and share of mention differences. Download full report to view findings by region and full listing of supplier rankings

Perspective from Percepta

Unprompted researcher opinion on which supplier has the most flexible pricing options provides an interesting snapshot of which companies researchers believe best meet their expectations for price, a key driver, for many customer types in purchase decision making.

Clear variation in opinion across geographical regions provides life science marketing groups with some insight into regional preferences woven together with supplier origins, history and also recent price reductions in a given region.

We believe it is important for readers of this report to stop and consider how to use stated supplier preferences as opposed to derived preference and researcher behavior when it comes to making purchasing decisions. For example, while researchers may state accuracy of their experiments is the most important consideration when making product purchasing decisions, price and brand of the products may weigh in much higher on their actual purchasing decisions. It is important to tease out these key drivers to position products in line with customer expectations.

Price Assessment Approaches – Tailored to Meet your Needs

At Percepta we offer tools and methodologies that can be used to help guide and inform tactical and strategic marketing decisions. The Percepta team has years of practical product development and pricing experience. Our deep understanding of the space means that that you can rely on Percepta to be an extension of your own internal expertise, helping you hone in on the best pricing strategy, at product launch or at various milestones in your product lifecycle. We tailor one of the following methodologies:

Conjoint Analysis – Conjoint analysis is a quantitative market research method that is based on the fact that realism yields the most credible data. Survey respondents are forced to make buying decisions based on a combination of features, requiring them to make difficult trade-offs as in real life. For example, end-users choose their preferred option from a series of product configurations, each having varying performance levels and prices. For understanding consumer preferences, this is in striking contrast to traditional online surveys, where ratings of product features can often show limited differentiation from feature to feature. Besides its ability to measure the importance of product features, preferred performance levels, head-to-head adoption scenarios with competing products, conjoint analysis is also used as a tool to model pricing options.

van Westendorp Price Sensitivity Analysis – The van Westendorp Price Sensitivity Analysis (PSA) is a powerful method that is based on the assumption that price is a fundamental reflection of value and that customers understand enough about the market landscape to express valid opinions related to acceptable product prices. This approach relies on a series of simple questions and the aggregate analysis of answers to these questions helps arrive at an optimal price point and a range of acceptable prices for the product (or service) of interest.

To read more about Percepta’s price assessment approaches:

OR

Leave a Reply